ClearPay 4 Step Process:

- Carrier receives Approval Notification and Reconciliation Report

- ClearPay Generates Electronic Funds Transfer on Required Date

- Funds are Deposited into Carrier Account

- Carrier Receives Deposit Confirmation and Account Summary

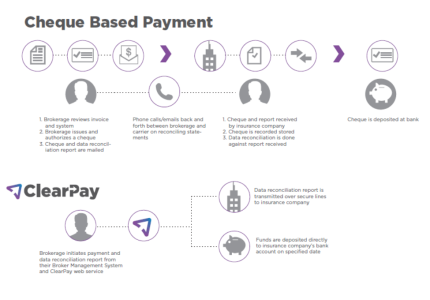

The current process of settling monthly agency bill accounts and one-time payments (midterm policy changes, NSFs on direct bill business) is antiquated and overly complex. Carriers currently invoice amounts that may differ from that in a brokerage’s BMS, the payment process is not secure, is heavily paper based and takes away value from the operations of brokerages and carriers.

How is ClearPay different? Payments via ClearPay to the carrier are initiated by brokerages within their BMS under the cheque issuing function. Payments are then established by ClearPay and policy reconciliation data is remitted to the carrier. ClearPay works within Canadian Banking protocols and is compliant with all insurance regulatory authorities in transferring funds directly from the brokerage’s to the carriers account.

How does ClearPay compare:

Current Cheque Based Process:

- Query broker payment status

- Receive cheques

- Sort and distribute cheques

- Enter cheque details

- Receive reconciliation data (various formats)

- Enter reconciliation data

- Store cheques

- Physically deposit cheques at bank

- Accounting reconciliation (month end)

ClearPay™ Process:

- Receive ClearPay™ payment notification with reconciliation data

- Enter payment details

- Enter reconciliation data

- Accounting reconciliation (month end)

ClearPay

ClearPay