ClearPay 4 Step Process to Receive Payments:

- MGA receives Approval Notification and Reconciliation Report

- ClearPay Generates Electronic Funds Transfer on Required Date

- Funds are Deposited into MGA Account

- MGA Receives Deposit Confirmation and Account Summary

ClearPay 4 Step Process to Send Payments:

- Submit Payment from BMS

- Notification and approval process

- Posted to ClearPay™, Reconciliation Report to carrier

- Carrier Receives Payment and Account Summary

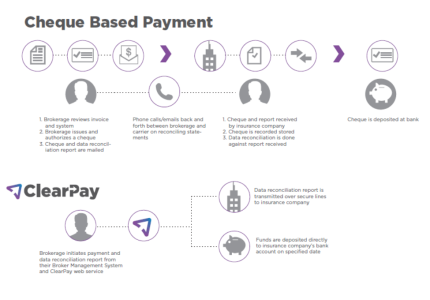

The current process of settling monthly agency bill accounts and one-time payments (midterm policy changes, NSFs on direct bill business) is antiquated and overly complex. Carriers currently invoice amounts that may differ from that in a brokerage’s BMS, the payment process is not secure, is heavily paper based and takes away value from the operations of brokerages, MGA’s and carriers.

How is ClearPay different? Payments via ClearPay to the carrier are initiated by brokerages within their BMS in the same manner as is done now to issue a cheque. Payment schedule is then established by ClearPay and policy reconciliation data is remitted to the carrier. ClearPay works within Canadian Banking protocols and is compliant with all insurance regulatory authorities in transferring funds directly from the brokerage’s to the carriers account.

How does ClearPay compare:

Current Cheque Based Process:

- Enter payment data into accounting software (BMS)

- Print cheques

- Print/export reconciliation data (for approval)

- Request required approval and signatures (x2)

- Generate outgoing envelopes

- Send Reconciliation data to carrier

- Call courier/put stamps and deposit at mailbox

- Hope cheques/data make it to carrier.

ClearPay Process:

- Enter payment data into accounting software (BMS)

- Authorize payment which generates ClearPay automated approval notification

- Receive automated receipt notification

ClearPay

ClearPay